Real estate investment in Ghana has become an increasingly attractive option for investors looking to diversify their portfolios and tap into the country’s promising real estate industry, the country with a stable political environment, a young and rapidly urbanizing population, and rising incomes, Ghana’s real estate sector presents exciting opportunities in all categories of real estate, the residential, commercial, and industrial properties. This is a series brought to you by the Africa Continental Engineering & Construction Network Ltd (www.acecnltd.com) that seeks to provide asystematic exposition on the real estate investment opportunities in Africa. Today’s article is part one (1) and we shall be examining five (5) fundamental factors (indices) that positions Ghana strategically, as the most preferred destination for real estate investment in Africa. The Ghanaian political environment, rate of urbanization, middle class growth, Ghana as the African hub for tertiary education and most importantly, Ghana’s housing deficit.

Real estate investment in Ghana has become an increasingly attractive option for investors looking to diversify their portfolios and tap into the country’s promising real estate industry, the country with a stable political environment, a young and rapidly urbanizing population, and rising incomes, Ghana’s real estate sector presents exciting opportunities in all categories of real estate, the residential, commercial, and industrial properties. This is a series brought to you by the Africa Continental Engineering & Construction Network Ltd (www.acecnltd.com) that seeks to provide asystematic exposition on the real estate investment opportunities in Africa. Today’s article is part one (1) and we shall be examining five (5) fundamental factors (indices) that positions Ghana strategically, as the most preferred destination for real estate investment in Africa. The Ghanaian political environment, rate of urbanization, middle class growth, Ghana as the African hub for tertiary education and most importantly, Ghana’s housing deficit.

Purpose

The purpose is to help potential investors make informed decisions in the event they so wish to venture into the African real estate market, for that matter the Ghanaian market. Now, take a seat, grab a glass of chilled drinks and come along with us as we run you down a data driven analysis on the prospects of real estate investment in Ghana.

1.Ghana’s Political Environment

First and foremost is the Ghanaian political environment, since the adoption of the 1992 constitution, Ghana have enjoyed political stability and have become a global center of attraction and a case study for many African nations and beyond. It is therefore not by chance that the Global Peace Index (2022) ranked Ghana as the 2nd most peaceful country in Sub-Saharan Africa among 46 others, top six (6) most peaceful countries in Africa and the 40th most peaceful country in the world out of 163. This guarantees security at all levels and gives confidence to the investor community that every dollar worth of investment within the shores of Ghana is secured regardless of which political party is in government. The supremacy of the constitution and the rule of law ensured the checks and balances among the arms of government. The Police Service, the Army, the National Security and all other state institutions mandated to keep democratic balance and political stability have always worked in synchrony, thereby placing Ghana ahead of its peers in Africa to emerge as the most preferred African state for both local and foreign direct investment, of which real estate investment is not an exception.

2.Ghana’s Housing Deficit

In addition to the stable political environment, the Ghana Housing Deficit presents a profound real estate investment opportunity. According to the Ghana Statistical Service (2022), Ghana’s housing deficit stood at a staggering rate of 1.8 million. This has made the provision of more affordable housing options for urban dwellers a big challenge for the Ghanaian government.

State Intervention

The state has over the years undertaken a few housing projects and policy interventions in attempt to bridge the gap, however, this was quite unsuccessful as the deficit continue to grow with time. Efforts have been made by private individuals which contributes but little to closing the gap, leaving the few private institutional developers a huge housing supply gap to meet.

Private Developer’s Input

GREDA (Ghana Real Estate Developers Association) appears to be the only beacon of hope if the housing supply will ever meet the demand. But for potential investors to appreciate where the investment jackpot lies within the property supply landscape in Ghana, we would like to run you through a brief but empirical analysis.

Property Development Mix

There are currently about one hundred and forty (140) private real estate developers in good standing in Ghana according to GREDA real estate journal (2023). The 140 have various specialties within the sector, that is to say it is not all of them that are into residential property development.

Analysis

However, for the purpose of this analysis, we shall assume that all of them develop residential properties.

What this implies essentially is that, each developer will have to develop approximately thirteen thousand (13,000) housing units, though not feasible, within the year to be able to bridge the 1.8million gap. This shows how huge the real estate investment opportunity is, in Ghana that cannot be compared to any other destination in Africa.

3.Increasing Urbanization Rate

Moreover, another index worth mentioning is Ghana’s increasing rate of urbanization, according to Urban Land Institute, London (2018), urbanization leads to high demand for housing in urban centers thereby putting pressure on residential properties and consequentially leading to high rates of rent in the urban centers across the world.

It was against this backdrop that we decided to explore the rate of urbanization in Ghana and its impact on real estate investment opportunities. Ghana’s increasing rate of urbanization is another index that gives prospects to real estate investment particularly in Ghana’s urban centers across the country

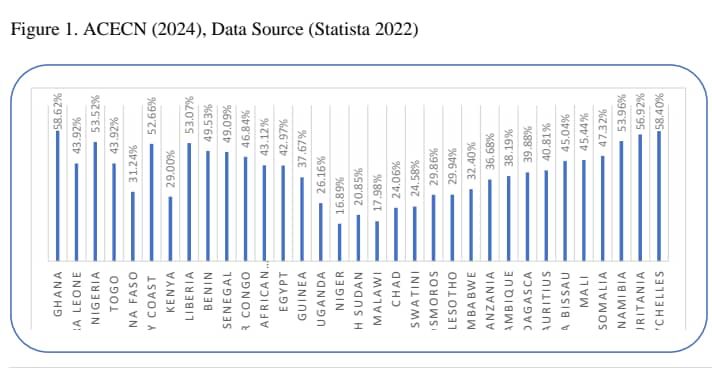

A recent observation made by our outfit, the Africa Continental Engineering & Construction Network (ACECN) on some selected African countries points to the fact that Ghana has the highest rate of urbanization, (ACECN, 2024).

This again positions Ghana as the most preferred destination for real estate investment in Africa. The figure below is the graphical representation of the rates of urbanization with Ghana topping the list with 58.62% in 2022.

4.Growing Middle Class

Also, the ever-growing middle class is another crucial index worth considering, Africa is developing faster than it was in the 20th century, it is therefore not a surprise to see many economic indicators assuming positive resilience across the African continent.

Ghana have had its share of this rapid development over the years. In 2013, the African Development Bank (AfDB) published that about 46% of Ghanaians are now classified as middle class compared to a continent-wide average of 34.3%.

Eleven years down the line, this may have grown above 50% except the gains eroded by the two-year COVID-19 pandemic. It is also interesting to know that majority of these middle class live and work in the cities particularly the national capital, Accra.

This has put a lot of pressure on residential facilities in Accra leading to the prohibitive rental prices recorded consistently over the period. This again demonstrates how huge and promising the prospects of real estate investment are, in Ghana using the capital city in particular as a destination

Besides, Ghana’s sudden transformation into Africa’s Hub for Tertiary Education also contributes significantly to the sector investment opportunities. According to the National Council for Tertiary Education (2016) Ghana has positioned itself as one of the major providers of quality higher education in Sub-Saharan Africa.

For the past decade, Ghana has enacted policies, which have indicated to the global community, the strong intention to enhance the competitiveness of our tertiary education system. For this reason, the quota-based admission policy for foreign students was lifted in both private and public institutions.

This opened the floodgate to students and faculty of countries within Sub-Saharan Africa including Nigeria, Cameroon, Guinea, Gabon, Liberia, Sierra Leone, Congo Brazzaville, Equatorial Guinea, Togo, Ivory Coast, Cameroon, Zambia, Gambia, Rwanda and some East and southern African Countries.

This trend has skyrocketed the housing demand in the cities making property investment in Ghana exceptionally profitable. The trend gave birth to AirBnB which has gained its popularity in recent times, a term given to short term rentals for private residential facilities often targeted at consultants, business men, students, diplomats’ expatriates et cetera. AirBnB within the city of Accra is one of the rewarding property investment portfolios currently.

5.Rapid Population Growth

Last but not least, Ghana’s rapid population growth is another index that drives housing demand significantly.

The current population in 2024 stood at 35million approximately and is projected to reach 39million by 2030 as against a projected housing deficit of 4.2million by same year. Mention is not made yet of the black race around the world who are tracing their root back home and many settlings in and naturalizing in Ghana because of the political stability the country has enjoyed since independence.

This exodus of the black race to Ghana as their home was motivated by a conscious state policy dubbed, “the year of return” in 2019. Ever since, many interventions such as “beyond the return” and some other state programs aimed at supporting these diasporas assimilate into the Ghanaian system seamlessly.

That notwithstanding, several measures have also been put in place as an incentive to enable more returnees including citizens of fellow African countries migrating to Ghana to naturalize. Taking Nigeria for instance, about 77,000 Nigerians live and work in Ghana as reported by Statista (2021) and all these needs descent accommodation around the cities making property investment in Ghana more profitable than ever.

In conclusion, all indices points to the fact that Ghana tops the list and remains the most profitable destination for real estate investment in Africa. Subscribe and follow the Global African Times Magazine for part two (2) and subsequent articles in the series.

Author: Daniel Kontie (Email: d.kontie@acecnltd.com, Contact: +233209032280)

- Real Estate and Construction Consultant, Ghana

- CEO, Africa Continental Engineering & Construction Network Ltd (ACECN LTD)

- National President, World Sustainable Built Environment and Generative Artificial Intelligence Forum (WSBE-GenAIF)

- National president, Ghana Institution of Sustainable and Generative Artificial Intelligence (GhISBE-GenAI)