Associate Professor, China Studies Centre, University of Sydney

The Conversation ,First Published,26th November,2024

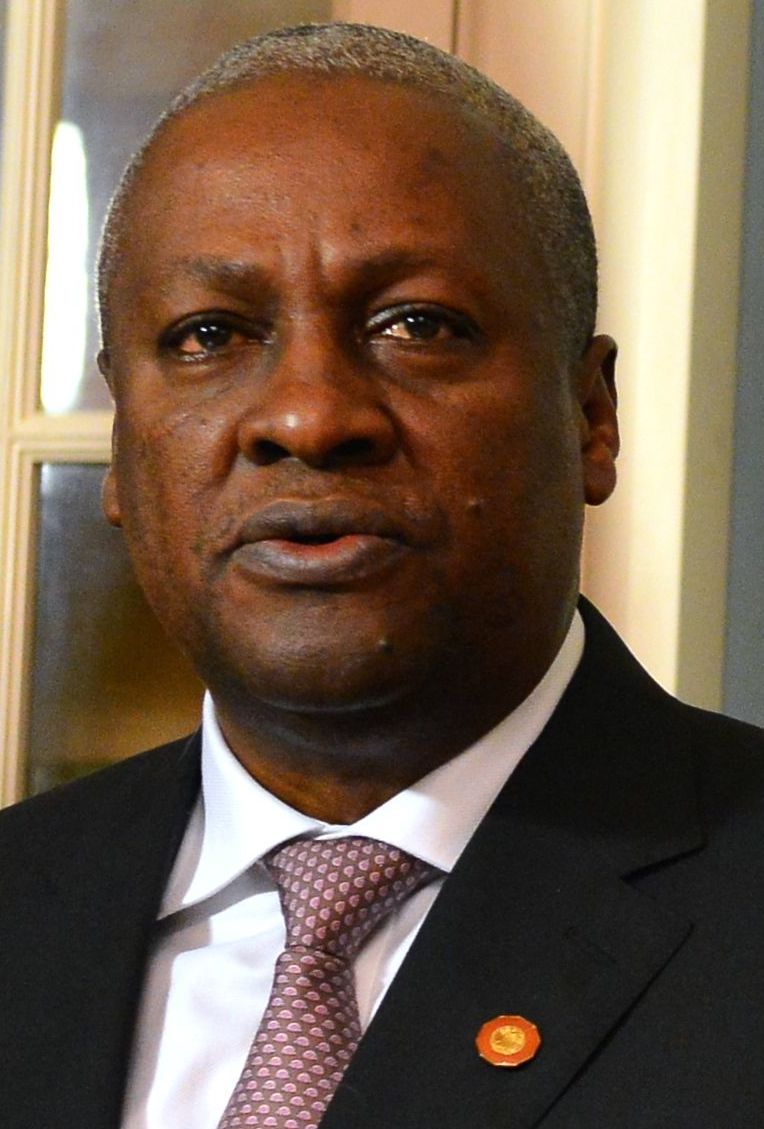

Photo(Brics Summit 2024)

Brics+ countries are exploring how they can foster greater use of local currencies in their trade, instead of relying on a handful of major currencies, primarily the US dollar and the euro.

The forum for cooperation among nine leading emerging economies – Brazil, China, Egypt, Ethiopia, India, Iran, Russian Federation, South Africa, United Arab Emirates – emphasised this determination at their 16th summit in October 2024.

Economist Lauren Johnston recently wrote a paper on this development. The Conversation Africa asked her for her insights.

Why do Brics+ countries want to trade in local currencies?

There are economic and political reasons to use local currencies.

Using local currencies to trade among themselves will lower the transaction costs and reduce these countries’ dependence on foreign currencies.

Over the past few centuries, the world’s economy has developed in a way that makes certain currencies more valuable and widely trusted for international trade. These include the US dollar, the euro, the Japanese yen and the British pound. These currencies hold value around the world because they come from countries with strong economies and a long history of trading globally.

When people or countries trade using these currencies and end up collecting or holding them, they consider it “safe” because the value of these currencies remains stable and they can be easily used or exchanged anywhere in the world.

But for countries in the global south, like Ethiopia, whose currency (the birr) isn’t widely accepted outside its borders, trading is far more difficult. Yet these countries struggle to earn enough of the major currencies through exports to buy what they need on international markets and to repay their debts (which tend to be in those currencies). In turn, the necessity of trading in major currencies, or the inability to trade in them, can create challenges that slow down economic growth and development.

Therefore, even some trade in local currencies between Brics+ members will support growth and development.

Oil exporter Russia is a unique case. Though there are fewer foreign currency constraints overall, Russia faces extensive financial sanctions for its war of aggression against Ukraine. Using a variety of currencies in its foreign transactions may make it easier to get around these sanctions.

Politically, the reasons for using other currencies primarily relates to freedom from sanctions.

One of the tools for making sanctions work is an international payments systems known as Swift (Society for Worldwide Interbank Financial Telecommunication). Swift was founded in 1973 and is based in Belgium. It enables secure and standardised communication between financial institutions for international payments and transactions. And it’s almost the only way to do this.

It was first used to impose financial sanctions on Iran in 2012, and has since been used to impose sanctions on Russia and North Korea.

If a country is cut off from Swift, it faces disruptions in international trade and financial transactions, as banks struggle to process payments. This can lead to economic isolation and challenges in accessing global markets.

The reality, and possibility, of exclusion from Swift’s payments system is one of the factors galvanising momentum towards a new payments system that also relies less on the currencies of the countries that govern Swift – like the euro, Japanese yen, British pound and US dollar.

What are the likely challenges they will face?

The Brics+ plan to use local currencies faces some hurdles.

The central problem is the lack of demand for most currencies internationally. And it’s hard to supplant the international role of existing major currencies.

If, for example, India accumulates Ethiopian birr, it can mainly only use them in trade with Ethiopia, and nowhere else. Or, if Russia allows India to buy oil in rupees, what will it do with those rupees?

Since most countries seeking alternatives to dollar dependence tend to sell more than they buy from other countries, or are lower-income importers, they must consider what currencies to accumulate via trade.

When it comes to payment systems, at least, alternatives are emerging.

Brics+ is creating its own, Brics+ Clear. Some 160 countries have signed up to using the system. China also has its own, Cross-border Inter-bank Payment System, which broadly works the same way as Swift.

There’s a risk, though, that these payment methods could merely fragment the system and make it even more costly and less efficient.

Has trading in local currencies been done elsewhere?

Not all trade is done in major western currencies.

For example, in southern Africa, within the Southern African Customs Union, the South African rand plays a relatively important role in cross-border trade and finance. Just as in south-east Asia the currencies of Singapore and Thailand compete to be the dominant currency in the sub-region.

China – the world’s biggest exporter and producer of industrialised goods – is also signing bilateral currency swap agreements with countries. The goal is greater use of the renminbi in the world.

As a means of circumventing sanctions, India and Russia recently trialled using the rupee to trade. Russia’s oil exports to and through India have risen strongly since the Ukraine war and some 90% of that bilateral trade takes place in the rupee and rouble. This leaves Russia with a challenge – what to do with all the rupees it has accumulated. These deposits are sitting in Indian banks and being invested in local shares and other assets.

Another example of efforts to side-step major international currencies is China’s model of “barter trade”. The model works like this: China exports, for instance, agricultural machinery to an African country and receives payment in that country’s currency. China then uses that currency to buy goods from the same country, which are then imported back to China. After these goods are sold in China, the Chinese trader is paid in renminbi.

Ghana is one country involved in this barter model. Challenges facing the model include the digitisation of payments and trade, and trust – high levels are needed to establish and maintain relationships between trading parties as individuals and as businesses. It also requires some level of centralisation and coordination, but lacks strong laws, regulations and industry standards. This means that different platforms and enterprises may not be compatible, which can add to transaction time and costs.

Another example is when Chinese investors in Ethiopia make profits in birr. They use these birr to buy Ethiopian goods, like coffee, and export the goods to China. In China, when they sell these goods, they receive renminbi. So they transfer their profits from Ethiopia to China by increasing Ethiopia’s exports to China.

Anecdotal reports suggest this is feasible at a small scale but has relatively high coordination costs.

There could be other challenges. For example, if Chinese buyers pay Ethiopian coffee farmers in their local currency, instead of US dollars, it could lead to fewer dollars being available overall. Some international transactions still rely heavily on dollars.

How should Brics+ nations structure their arrangement?

There is no simple, or easily scalable, solution to moving past the reliance on major international currencies or circumventing Swift.

A fast, digital payment system is needed. This system would calculate and balance currency demand efficiently. It must also be reliable, replace parts of the current system, and not create extra costs for countries that aren’t using it yet.

Although some Brics+ members, like Russia, may have more interest in fast-tracking change, this may be less in the interest of other Brics+ members. A move away from Swift, for instance, requires buy-in from local financial institutions, and those in African countries may not be under pressure to shift to a new lesser-known platform.

Given these challenges, I argue that Brics+ should progress incrementally. What can happen soon, though, is to conduct some trade in local currency.

SOURCE

THE CONVERSATION

Leave a Reply